Looking back at Viemed

How a sleepy DME became a quiet cash machine...

For nearly all companies I write about I keep following their earnings report and the announcements the company puts out. The same holds for Viemed which I covered back in Feb of 2023. I do not think any changes in the industry, valuation or company warrant a new write-up, however, since I came across a European peer of Viemed I wanted to review the US sector and what has happened in the past few years justifies a write-up on its own. Therefore, this will not be a complete in-depth write-up and more a refined brain dump with a simple valuation at the end of the article.

Current situation:

Diversifying their service mix

Diversifying their payor mix

Stable sector without expected secular decline

Accretive M&A, at very attractive multiples

Revenue CAGR

Since 2018 at 21.1%

Since 2020 at 12.8%

Trading at 8x FCF

Before continuing please read my previous write-up. Although I have come quite far in my writing ability and investing capacities, it is a decent place to get some starter knowledge:

Overview: Company

When I first wrote about Viemed it was essentially a single product story, a focused bet on non invasive ventilation (NIV) in the home and the idea that a respiratory therapy model could both save the health system money and keep very sick COPD and neuromuscular patients out of hospital. I have wanted to do a follow up for a while, partly to see whether that original thesis has travelled well through reimbursement scares and post Covid normalisation, and partly because the business itself no longer looks like a pure NIV mono line. The company has been quietly reshaped into a broader home respiratory and sleep platform, with a more mixed service and payor profile, and a small but growing portfolio of bolt on deals.

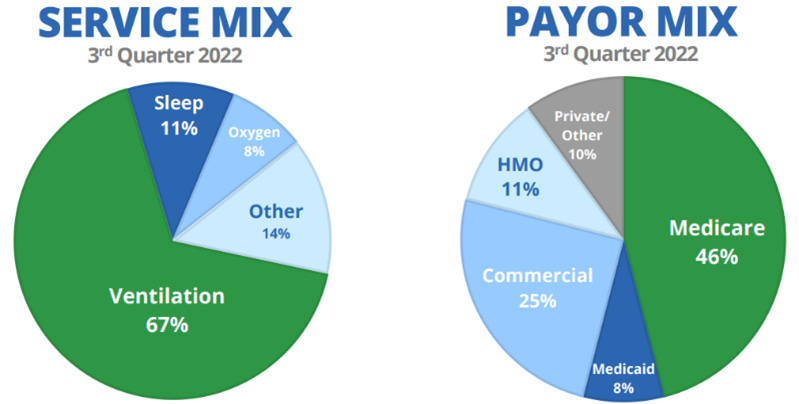

2022Q2:

2025Q3:

Viemed today is still first and foremost a provider of home medical equipment and post acute respiratory care services in the United States. It rents and sells ventilators, sleep therapy devices, oxygen concentrators, percussion vests and related supplies, and it supports these devices with a large field team of respiratory therapists who visit patients at home and via telehealth (Virtual consulting). The company now serves patients in all 50 states. The ventilator rentals remain the economic engine, accounting for a little more than 50% of revenue in 2024. Alongside ventilation, Viemed runs neuromuscular care programmes, in home sleep testing for sleep apnoea, oxygen therapy and a healthcare staffing arm that places clinical staff into third party facilities. The core pitch has not changed much since my original note, Viemed still sells payors on the idea that complex respiratory patients can be treated at home for less total cost and with better outcomes than in hospital, supported by real world data showing meaningful reductions in mortality, readmissions and emergency visits when non invasive ventilation is initiated early in the home.

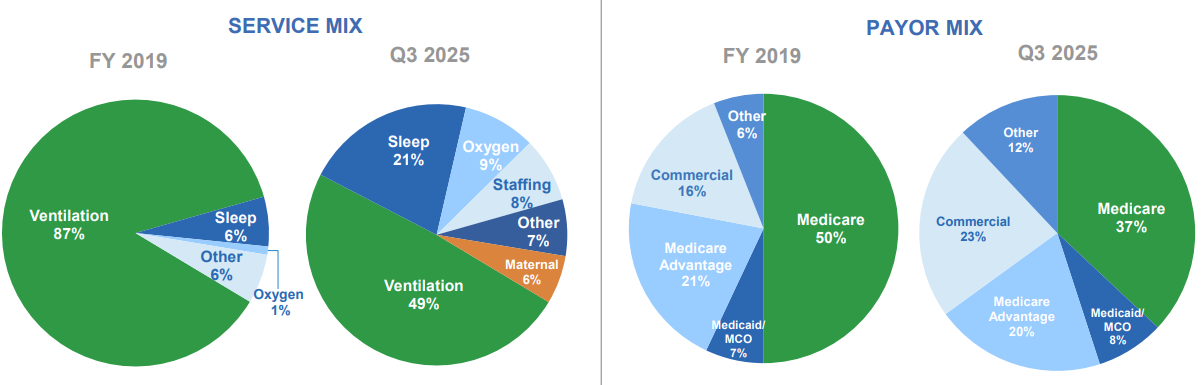

What has changed meaningfully is the shape and scale of the business. In 2019 Viemed was essentially a ventilation story, with vents representing close to ninety per cent of service mix. By the third quarter of 2025 a new maternal care line is now at 6% of revenue. Over the same period Medicare’s share of revenue has fallen from around 50% to the high 30's, while commercial, Medicare Advantage and other payors have taken a larger share of the payor mix. The result is a company that still lives and dies on complex respiratory economics but is far less concentrated in a single code set or payor class than when I first wrote about it.

Part of that shift has come from organic growth, particularly in sleep therapy and resupply. The company has been adding PAP therapy patients and sleep resupply patients at very high rates, with year on year gains well above 50% in the most recent disclosures, helped by a simple resupply model where eligible patients place repeat orders a few times a year at attractive average order values. Part of it, though, has been deliberate inorganic expansion.

Overview: M&A

In June 2023 Viemed bought Home Medical Products, a regional HME operator in Tennessee, Alabama and Mississippi, for roughly $29m in cash. The deal brought in a mature sleep resupply platform, additional geographies and a broader payor mix. Management described it as immediately accretive to earnings.

Home Medical Products (HMP) was the “first“ inorganic step away from a purely organic model. It brought Viemed a sizeable, respiratory-focused regional operator with 2022 net revenue of about $28m and adjusted EBITDA of roughly $6.8m. Included were multiple branches across Tennessee, Alabama and Mississippi. Viemed management said that the transaction would “launch our acquisition growth initiatives”, emphasising HMP’s reputation with patients, payors and physicians, and the cultural fit around high-touch patient care. Increasing / building out Viemed’s presence in the South East deepens coverage in some of the most COPD-heavy, rural and hospital-dense states in the US, which directly feeds their core vent and sleep opportunity. More employees on the ground there means denser routing, faster response times and tighter relationships with local physicians and hospitals, which compounds into a real competitive advantage, both cost and relationship wise. The acquisition also added a more mature sleep resupply division and added scale in contracts and back-office processes that can now be leveraged across the wider group.

In April 2024 the company took a 60% stake in East Alabama HomeMed, a joint venture with East Alabama Health that effectively ties Viemed into a hospital system as a structured referral channel and local operating partner. This acquisition pushed the model closer to the hospital. By taking a majority stake and managerial control of East Alabama HomeMed, they locked themselves into the health system’s discharge pathway, with the JV supplying home medical equipment to East Alabama’s own patients and the surrounding communities. Viemed Management called it a “blueprint that can be replicated nationwide”, which is really the key point: HomeMed is less about near term revenue, Viemed guided to around $4m of incremental annualised revenue from the transaction – and more about proving that it can partner with hospitals formally.

In July 2025, Viemed acquired Lehan Drugs in Illinois for about $28.7m. This acquisition added a strong Chicago platform, maternal health services, further sleep rental and resupply capability. The Illinois platform adds six locations in Northern Illinois and West-Chicagoland (including one in Wisconsin), a large commercial and Medicaid-heavy payer mix, and a whole new vertical in maternal health. The maternal health mainly consists of breast pumps and related women’s health products, on top of respiratory and sleep.

Where HMP was about deepening Viemed’s core respiratory and sleep presence in the South-East, Lehan is about opening in a large metro market and then rolling out a transactional, CapEx-light product line nationwide through Viemed’s existing contracts. In 2024 Lehan generated approximately $25.7m of net revenue and $7.4m of adjusted EBITDA, which makes it a meaningful bolt-on in its own right and a nice fit with Viemed’s focus on recurring resupply and high free cash flow conversion.

M&A Finance

Taken together, the three transactions move Viemed from being a single-track complex respiratory story with a growing sleep side hustle into something closer to a multi-service in-home platform. HMP and Lehan both extend the sleep and resupply engine and add dense regional footprints, while HomeMed forges the first proper institutional joint venture with a hospital system. All three sit comfortably within the existing operating model: they are DME and clinical services businesses, they lean on recurring rental and resupply rather than one-off capital sales, and they tap the same payer universe. The pattern is pretty clear: management is willing to do deals, but they have to be bolt-ons that are operationally familiar, immediately or quickly accretive and capable of being scaled through Viemed’s national infrastructure without blowing up the balance sheet.

Valuation paid

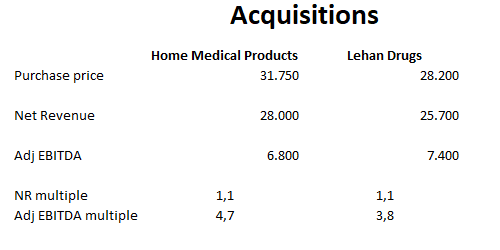

The table below sets out the disclosed valuation metrics for each transaction, based on company press releases, and gives a feel for how disciplined they have been on price.

So far, the pattern is pretty disciplined. Where numbers are disclosed, Viemed is paying roughly one times trailing sales and mid-single-digit EBITDA multiples for assets that are growing, strategically useful and immediately accretive. They are also keeping absolute cheque sizes in a range that can be funded from FCF and modest drawdowns on the revolver, without compromising the balance sheet or their ability to keep buying back stock.

Overview: Financials

On the financial side the company has scaled up but stayed broadly disciplined. Revenue in 2024 reached about $244m, up around 22.5% versus 2023, with net income a little over $11m and home medical equipment rentals and sales still accounting for roughly 91% of the top line. Through the first nine months of 2025 Viemed generated just over $194m of revenue and about $9.5m of net income, while continuing to invest heavily in fleet and acquisitions.

The latest investor presentation points to guidance of roughly $271 – 273m of revenue and $60 – 62m of adjusted EBITDA for 2025, implying an adjusted EBITDA margin around the low 20s and leaving the balance sheet with modest net debt and plenty of undrawn credit capacity. Management also highlight that they now support over 160,000 patients nationwide with what they describe as a capital light model, and that they remain only the third largest provider in a very fragmented NIV market where the top 10 operators control just over 60% of share and underlying COPD and OSA prevalence continues to grow.

Further financial information can be found in the valuation sector further below. Since this is not a complete write-up and more a follow-up I will not be going through their balance sheet and perhaps other weird

This follow up is therefore not just a routine check in on quarterly numbers. The question now is whether Viemed is evolving from a niche NIV champion into a more durable home respiratory and sleep platform, and whether that evolution improves or dilutes the original investment case. In the rest of the note I will revisit the thesis, look at how the new business mix and acquisitions change the risk and return profile, discuss why I think the market is still mispricing the company despite the improved diversification, and walk through the main catalysts, risks and valuation from here.

Overview: Sector

On the sector side it is worth stepping back for a moment, because the backdrop for Viemed has moved on a bit since 2023, even if the long term drivers have not really changed.

Back when I first wrote about Viemed, the home respiratory world was still shaking off the Covid hangover. Ventilators and oxygen equipment had been pulled forward into hospitals, Philips was deep in its PAP device recall, and a lot of the sleep apnoea market was constrained more by hardware supply than by underlying demand. The basic set up was clear though, a steadily growing pool of older and sicker patients with COPD and sleep apnoea, a payor system that would rather keep them at home than in hospital, and a fragmented ecosystem of DME suppliers and respiratory therapists sitting between the big device manufacturers and the health plans.

That picture is still broadly right, but a few things have sharpened up. Globally, respiratory care devices are now a mid twenty billion dollar plus market, with expectations of roughly high single digit annual growth through the next decade as COPD, asthma and sleep apnoea continue to rise and more care shifts into the home. North America accounts for a bit more than a third of that market and remains the most attractive region from a reimbursement and penetration perspective. (precedenceresearch.com) Within that, COPD is still the single biggest clinical driver, representing around 40%+ of respiratory device use in the United States, while sleep apnoea is the fastest growing segment, helped by better home sleep testing, more comfortable CPAP devices and increasing recognition of the long term cardiovascular impact of untreated OSA. (Mordor Intelligence) The specific niche that Viemed plays in, home based NIV and related therapies, is smaller in absolute terms but is now typically described as a low to mid single digit billion dollar global market growing at about 6% - 7% per year.

Analysts expect US home respiratory therapy to grow strongly through 2035 off the back of rising COPD and sleep apnoea prevalence, high smoking legacies in parts of the population and increasing obesity. Adoption of portable oxygen concentrators, newer generation CPAP machines and connected monitoring platforms continues to increase, and reimbursement from Medicare and private payors for home respiratory appliances and remote patient monitoring is a key enabler of that shift. (Future Market Insights) The sector is still fragmented at the provider level. You have a handful of large national DME and respiratory providers, a long tail of regional HMEs, and then local shops and hospital affiliated programmes. Viemed sits at the smaller national end of that spectrum, but in a subsegment where there is real clinical complexity and where having respiratory therapists in the field is a differentiator.

What has changed since 2023 is less the long term demand changes and more the policy and competitive environment. On the competitive side, the Philips PAP recall is now largely in the rear view mirror and supply has normalised, which means the big sleep OEMs and large DMEs have returned to more normal replacement and resupply cycles rather than triaging scarce devices. GLP-1 weight loss drugs have started to bite at the narrative level, with some investors asking whether better obesity management eventually reduces sleep apnoea incidence, but in practice the installed base of diagnosed OSA and COPD patients is so large, that any volume impact will take years to show up in hard numbers.

Policy changes

On the policy side the big development for the sector is the national coverage determination for home based NIV in chronic respiratory failure due to COPD that CMS finalised in twenty twenty five. Before that, coverage was largely set through local rules, so criteria could differ materially between Medicare contractors. The new decision puts a single national framework around when Medicare will pay for respiratory assist devices and home mechanical ventilators in the home for this group of COPD patients. For Viemed this takes a lot of interpretive risk out of the system and makes the environment more predictable, even if it narrows the pool of patients who qualify for the highest acuity devices.

Underneath that sit Medicare and Medicaid. Medicare is age and disability based, most people come in at 65, younger people qualify through disability or certain severe diseases. Medicare pays most of the approved amount and the patient usually carries a coinsurance and deductible, unless they have supplemental cover. Equipment is either rented continuously, in the case of ventilators, or moves to patient ownership after a capped rental period, in the case of CPAP and many other devices.

Medicaid is tested and run by the states within federal rules. There are two type of broad versions states can “run“:

Expansion states cover most low income adults up to a given income threshold;

Non-expansion states are much stricter, and Medicaid either pays directly for respiratory care or wraps around Medicare for people who have both types of cover.

The biggest recent change has been the unwinding of the Covid period rule that kept people continuously enrolled in Medicaid, which has led to millions of beneficiaries moving off the programme or churning between Medicaid, exchange plans and periods with no insurance. For a home respiratory provider that means more volatility in coverage and mix in some states, particularly those with large low income populations.

Policy over the last administration has mostly been about coverage stability and drug benefits rather than dramatic changes to DME. The Inflation Reduction Act brought in drug price negotiation and caps for Medicare pharmacy spending, which tighten budget pressure over time but do not directly target respiratory equipment. In the DME and home health world CMS has offered modest payment updates and some temporary relief for non-competitive bidding areas, while also allowing telehealth flexibilities from the pandemic period to run on. This in turn supports remote evaluation and follow up in home based care. At the same time Medicare Advantage has grown to cover a rising share of beneficiaries, and those private plans use prior authorisation heavily for services including DME. That shifts more day to day utilisation control from CMS to insurers, which can be a headwind if they squeeze access or a tailwind if they buy into the savings from avoided admissions.

Looking ahead I expect the following three forces to shape the future of this sector:

Demographics and disease burden are firmly in favour of home respiratory care, with an ageing population, large pools of undiagnosed or undertreated COPD and OSA, and accumulating evidence that well run home therapy reduces mortality and hospital use.

Cost pressure is pushing care out of hospital and into the home, which aligns with what Viemed does, but the same cost pressure will keep reimbursement, competitive bidding and prior authorisation under the microscope.

The new NIV coverage decision reduces one important source of uncertainty, but it does not freeze the rules.

For us as investors the key question is now whether Medicare, Medicaid and the large commercial payors will lean into home NIV as a proven cost saver or keep it at this level.

Conclusion

I did not end up buying Viemed at the end of the article I posted in 2023 due to the lofty valuation of 44x earnings or a PEGY ratio of 1.76x. I tell myself that I have gotten better at investing during the years and try to refine my valuation method even on companies that I do not follow anymore.

For Viemed there I believe Free Cash Flow (FCF) is the best method to value the company due to its reliance on consistently reinvesting to buy new equipment, which is a cyclical flow.

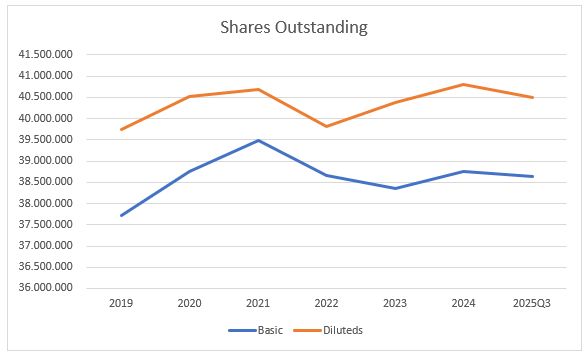

Shares outstanding are basically flat over the past few years compounding at a CAGR of 0.45% a year. Therefore, I will just assume that during the coming years they will repurchase about the same as they issue to both management and for acquisitions.

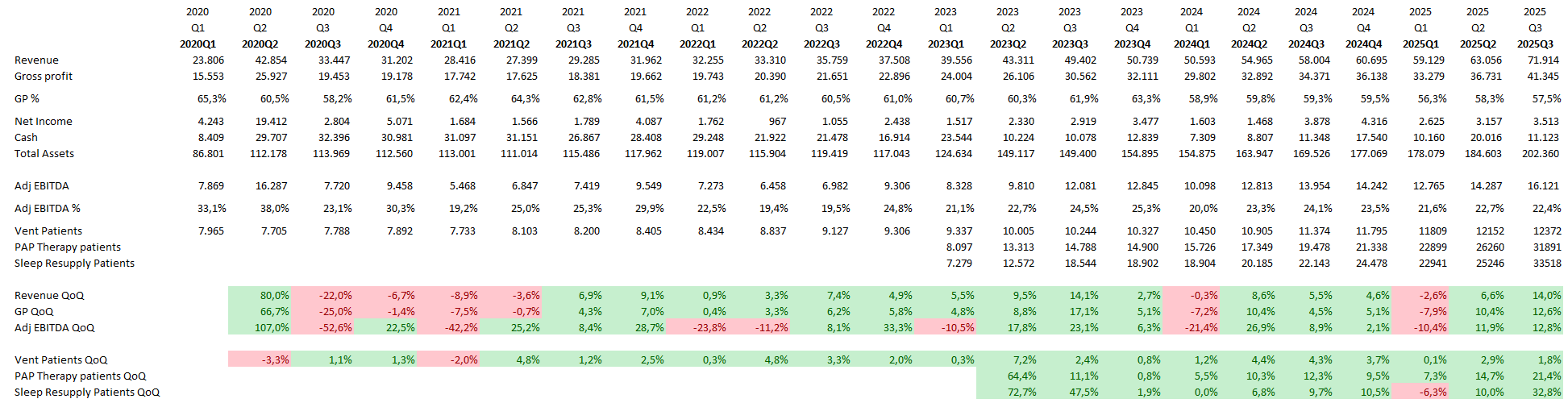

I track the quarterly data quite close and believe this is a very simple and quick way to see how the company is doing without needed to do more than read the conference calls and update my sheet.

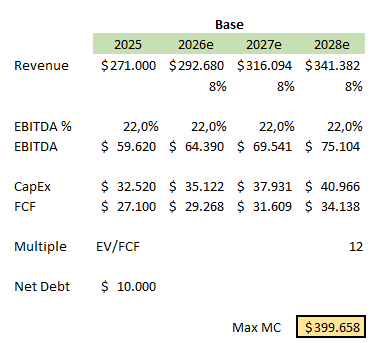

Like always I make three valuations, bear, base, and bull. I could share all three of them, however, I feel that the base case encompasses 80% of what I think will happen.

My assumptions:

Revenue growth will be 8%

Adj EBITDA will stand at about 22.0%

CapEx as a percentage of revenue will be around 12%

Company will stay at net debt of $10m

Revenue has compounded at a rate of 12.8% since 2020, if we assume that management will hit the $271m in revenue for 2025. Even tough 2020 was an outstanding year due to the government purchasing the ventilators due to covid-19. Adj EBITDA is just under the 5-year trailing median and average, with lower profitability in 2022 and higher during 2021 and 2023.

Seeing as this is 44% higher than the current market capitalisation you all (the three people reading this) will probably think well you must be buying it?? Well the answer is still no, the base case CAGR until 2028 is only at 15% and thus falls short of my 25% base case requirement.

Risks:

Reimbursement and policy risk

Viemed depends on Medicare, Medicare Advantage and Medicaid staying reasonably friendly to home based NIV and sleep, so any new cut, competitive bidding round or tighter coverage criteria can reset earnings power overnight and trigger a violent de rating.

GLP-1 and disease pool risk

If metabolic drugs and other preventive care actually bend the curve on obesity, diabetes and COPD progression over the next decade, the long term pool of late stage respiratory patients that Viemed serves could shrink. I do not think this is a near term risk but more a terminal risk.

Diversification and acquisition integration risk

The move into sleep, staffing, hospital JVs and maternal health makes the revenue base broader but also more complex to operate, and a badly chosen or poorly integrated deal could quietly drag down margins and returns. The risk is less “one big blow up” and more a slow dilution of the high return core respiratory franchise.

Closing:

I will be closely monitoring the situation and perhaps might buy some shares in the future! Thank you for ready my Substack article and I hope that you at least learned 1 single thing from this entire article. If you have any questions feel free to DM me on here or on X (formerly know as twitter). Please also let me know any feedback you have!!

I/we have a no beneficial long position or short position in the shares of VMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in this article.